Ways to Donate / Gift of Stock

Give a Gift of Stock

Giving a gift of stock to Food For Health is simple, and saves you money. Stock gifts provide one of the most significant tax breaks from the IRS. When you donate appreciated securities (you’ve owned for more than one year) you will receive two tax benefits:

- You are entitled to a federal income tax deduction based on the current fair market value of the securities, regardless of the original price you paid.

- You will be exempt from paying capital gains taxes on any increase in value.

Gifts of stock can be directed to general support of Food For Health or to a specific program you are passionate about.

For questions regarding donating mutual funds, IRAs, insurance policies, property, or other securities, please contact Liz Hall at 414-539-3525 or email gifts@foodforhealth.org.

Stock giving is as easy as 1,2,3:

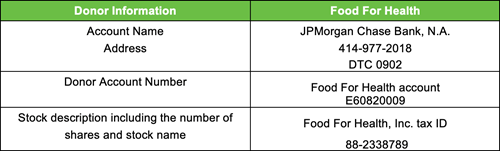

- Contact Food For Health at 414-539-3525 or gifts@foodforhealth.org to notify us that you will be making a stock donation.

- Contact Food For Health’s J.P. Morgan Private Bank’s broker at 414-977-2018 to process stock donation.

- J.P. Morgan Private Bank will send a letter or email to Food For Health regarding the gift and an acknowledgement of the gift will be mailed to you.

Please note: Stock gifts are non-cash, in-kind donations. Food For Health’s policy is to sell gifts of stock upon receipt so the funds can be used to support our mission to help save lives through the power of food. After receipt of a stock gift through our broker, Food For Health will promptly send an acknowledgement letter to the donor which reflects the number of shares and a description of stock donated, but not the value of the stock. Per IRS rules (Publication 1771, page 3), Food For Health cannot include the value of stock with a tax receipt. Food For Health will provide a copy of any broker correspondence under separate correspondence. The donor may also request the value of the stock directly from their financial institution.